Last month, the U.S. Small Business Administration (SBA) released the updated regulations for the SBA 504 Debt Refinance program.

As promised, we want to give you a brief overview of these new rules and showcase what they look like in action.

So here’s the “scoop”…

At the core of these new regulations is the same SBA 504 Debt Refinance program you know and love.

Expansion Amount Increase

The amount for debt refinance with expansion was increased from 50% to 100% of expansion costs.

Government Guaranteed Debt

The new debt refinance regulations now allow the straight refinance of government guaranteed debt such as SBA 504 or SBA 7a loans.

Qualified Debt Updates

Qualified Debt that is 6 months old is now eligible for straight refinance (as compared to 2 years).

As a reminder, you can still use the SBA 504 debt refinance program for cash out for business expenses, subject to program rules and regulations.

All other SBA 504 Debt Refinance rules apply. Subject to complete review of eligibility.

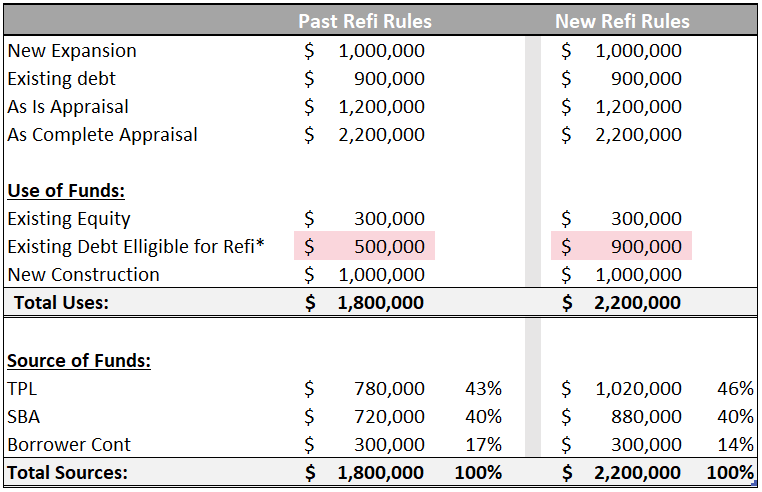

Debt Refinance with Expansion:

An existing ice cream shop is building an addition to expand capacity. Cost of the expansion is $1,000,000. The business has an existing mortgage with a balance of $900,000 outstanding that incurred 12 months ago.

*Previous Ruling:

- Refinance of existing debt is ineligible as it is less than 2 years old – therefore there would be no refinance project

- If the existing debt was over 2 years old, then $400,000 of the existing debt would be ineligible for refinance as refinance of existing debt is limited to 50% of New Expansion costs ($1,000,000*50%=$500,000) – see example below

*New Ruling:

- Existing debt refinance can be equal to total new expansion amount ($1,000,000*100%=Full $900,000 is eligible)

- Existing debt is now eligible for refinance (>6 months)

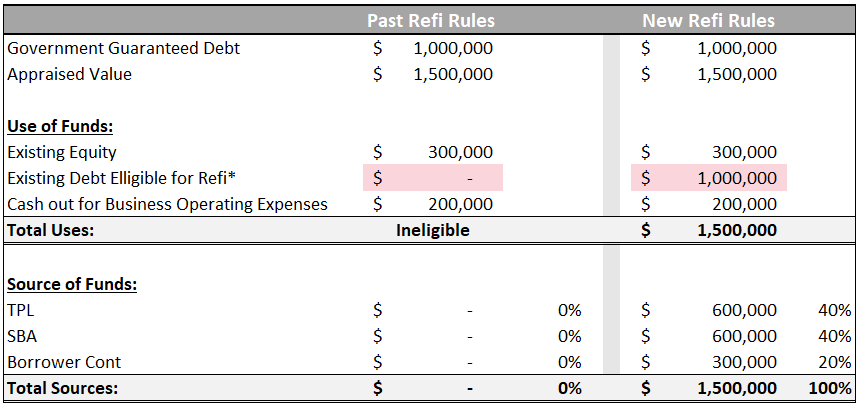

Straight Debt Refinance of Government Guaranteed Debt:

Ice cream shop with an existing SBA 7a or 504 loan from original construction of their building. The business has a $1,000,000 balance on that loan that was incurred 5 years ago. Because of COVID-19, they are needing additional working capital to get through the winter.

*Previous Ruling:

- Government Guaranteed Debt is ineligible

- Cash out for business operating expenses max. 20% of appraised value and subject to max. LTV of 85%

*New Ruling:

- Government Guaranteed Debt is now eligible under specific conditions

- No change in cash out rules

Check out our SBA 504 Debt Refinance webpage and download our SBA 504 Debt Refinance checklist below for more information.

Contact us with questions or to further discuss your project and eligibility.