If you’re a small business owner, you’ve probably heard of the SBA 504 – a loan program designed to help small business owners start, grow, or expand their business.

But what exactly does this loan program entail, how can it be used, and what advantages does it offer for current and aspiring entrepreneurs?

We’re here to give you the 411 on the 504 and all that it can do to help small business owners throughout their business journey.

SBA 504 Quick Facts:

The SBA 504 was established by the U.S. Small Business Administration and is named after Section 504 of the Small Business Investment Act of 1958, where it was originally created.

The goal of the program is to promote economic development and retain quality jobs through the financing of long-term, fixed assets (commonly including real estate or equipment) at a fixed, below-market rate.

Certified Development Corporations (CDCs) are non-profit corporations set up by the SBA to support the economic growth and provide this financing opportunity to small businesses. There are currently over 270 CDCs across the nation.

Eligible Uses:

- Real estate acquisition, construction, renovation, or expansion (including purchase of land)

- Land and site improvements

- Purchase and installation of new equipment or machinery

- Business acquisition or partner buyout

- Straight refinancing of commercial real estate, eligible fixed assets, & cash out for operating expenses

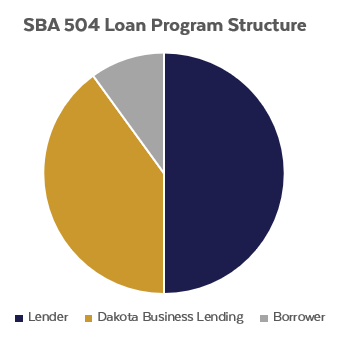

SBA 504 Loan Structure:

SBA 504 loans are typically structured 50-40-10 and work with three individual parties:

- A third party lender (50%)

- The SBA (40%)

- The borrower (10%)

Structures may vary based on eligibility, use, and business needs.

Benefits to Small Business Owners:

- Less cash up front – Because of this unique 50-40-10 structure, SBA 504 borrowers can finance up to 90% of their total project costs from sources outside of their own pocket (structure may vary depending on eligibility criteria).

- Improved cash flow – The SBA 504’s 10-, 20-, or 25-year terms are longer than conventional financing options, giving borrowers the opportunity to spread out their payments and increase their cash flow for day-to-day operations.

- Historically low, fixed rates – Interest rates for the SBA 504 loan program at a below-market rate. These rates will remain fixed throughout the duration of the loan, saving borrowers thousands of dollars compared to conventional loan programs. Today’s rates are historically low around 3%.

- Low down payment – The SBA 504 program requires a minimum 10% down, which is over 15-20% lower than conventional loans. This allows borrowers to keep more money in their pockets for business expenses rather than paying it up front.

BONUS Opportunities:

SBA 504 Debt Refinance – like the SBA 504, the SBA 504 Debt Refinance program is a great long-term, fixed rate financing option. This program allows borrowers to restructure their existing debt and cash out equity for working capital.

SBA 504 + PACE/Flex PACE from the Bank of North Dakota – With the SBA 504 loan program, you have the option to layer or stack other various resources to meet your business needs. Projects with the PACE/Flex PACE programs are structured similarly to an SBA 504 loan but provide the opportunity to buy down the interest rate that applies to the 504 lender’s portion of the project, giving you an even better deal for your business.

For more information, visit our SBA 504 webpage.